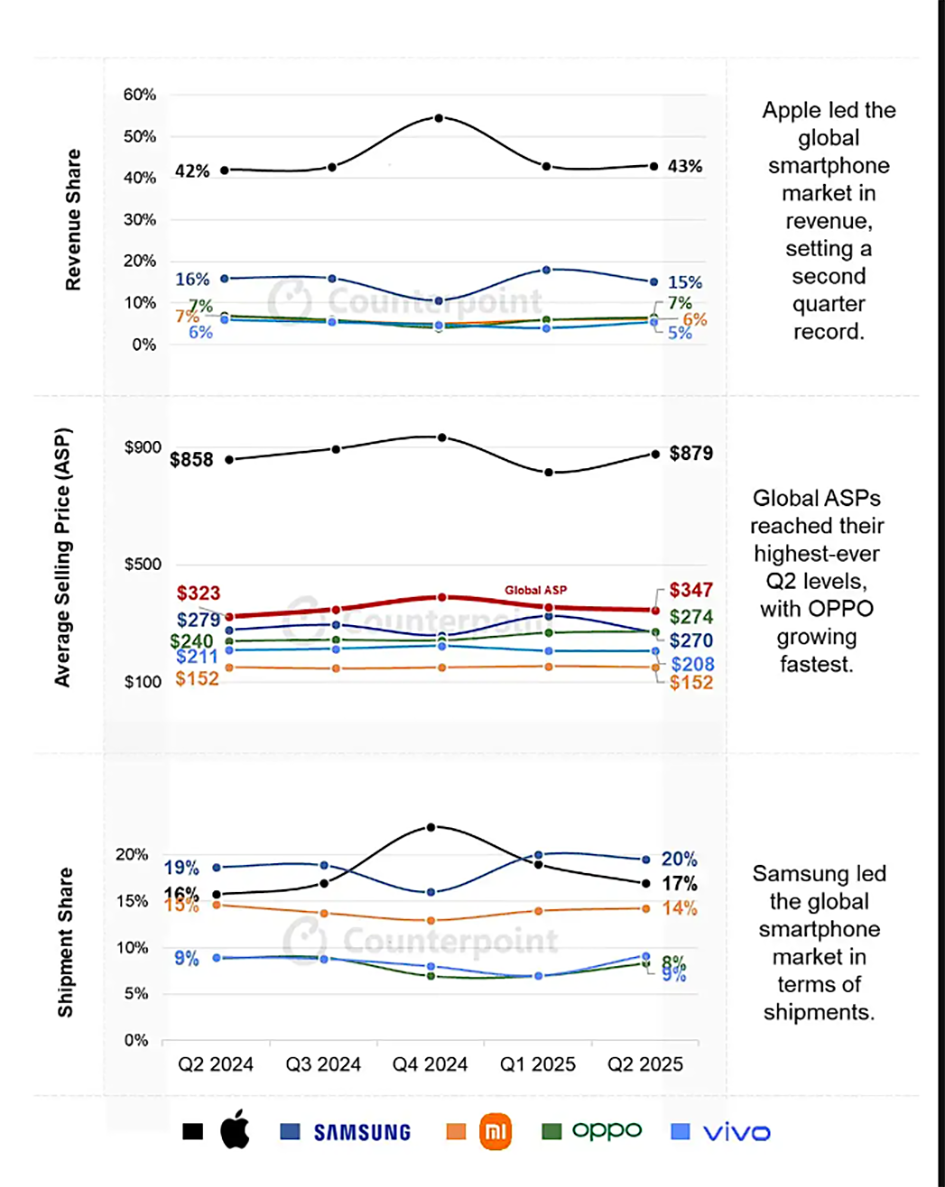

The global smartphone market put up a strong showing in the second quarter of 2025, with both shipment numbers and market value posting considerable gains. According to a new report by market researcher Counterpoint Research, there was a 3% year-over-year growth in worldwide smartphone shipments.

More importantly, the overall shipment value grew by 10% year-over-year to surpass the $100 billion threshold for the first time in any second quarter. This strong growth came alongside a 7% hike in the worldwide Average Selling Price (ASP) to a Q2 record of $347, pointing to a sustained trend of premiumization and increased-value phones across the sector.

Key brand performances behind market expansion

The Counterpoint report spells out the differing performances of major smartphone brands that together powered this market growth. Apple, for one, topped the bill among the top five brands with a rousing 13% growth rate during Q2. The Cupertino behemoth was helped strongly by the premiumization trend that continued unabated and, quite notably, by consumers buying the iPhone 16 series early, possibly to avoid tariff risks in the future.

This strong showing enabled Apple to garner a commanding 43% of the overall global smartphone revenue, highlighting its tremendous profitability and market sway. In addition, Apple retained the highest Average Selling Price in the market, averaging a whopping $879.

In the meantime, Samsung maintained its top spot in global smartphone shipment volume, showcasing its wide market penetration. The South Korean technology behemoth had its revenue increase by 4% year-over-year, a boost that was mostly driven by robust demand for its best-selling mid-range A series smartphones. The premium segment also helped, with the Galaxy S25 series and the recently launched S25 Edge giving its high-end market performance a big push. OPPO also made significant inroads, recording the fastest ASP growth among the top five brands, with a 14% year-over-year growth that took its average price to $274 in Q2.

In spite of the reported decline in sales volume, OPPO’s steady push into the high-end segment, especially with its Reno 13 series and Find X8 smartphones, allowed it to record a respectable 10% year-over-year revenue growth. Lastly, Vivo also supported the market’s upward trajectory, with its revenue increasing by 4% and shipment volume rising by 5% in Q2 2025.

The brand’s strategic emphasis on growth in core emerging markets yielded results, as it continued to expand its presence in India, the Middle East, Africa, and Latin America. At the same time, Vivo gradually expanded its market share in Europe, reflecting a balanced strategy towards both mature and emerging markets. The overall landscape of the global smartphone market in Q2 2025 is that of robust growth, fueled by rising average selling prices and an evident consumer trend towards more premium offerings. This augurs well for the future of the industry, as manufacturers persist with innovation and address a global consumer base that is increasingly discerning.

Erencan Yılmaz

Erencan Yılmaz