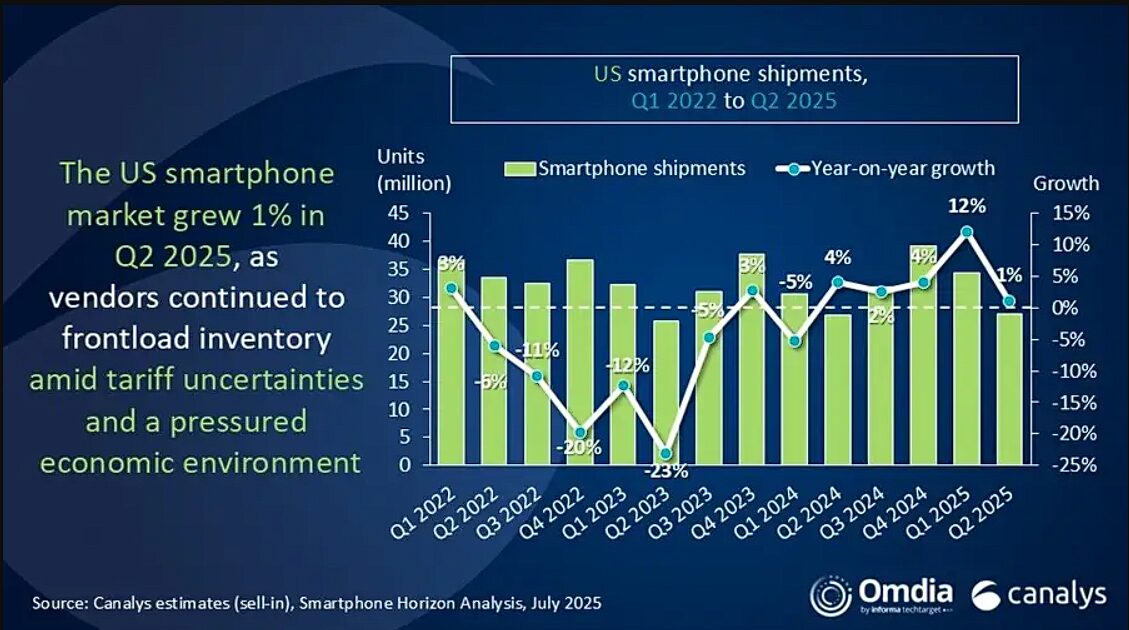

The United States smartphone market experienced a modest 1% growth in the second quarter of 2025, a period marked by manufacturers actively increasing their inventory shipments to preempt potential tariff changes and navigate a challenging economic climate. This strategic “frontloading” of inventory by vendors was a key factor in the slight market expansion.

The data reveals not only subtle shifts in consumer demand but also a significant reorientation of global smartphone manufacturing hubs supplying the US market, as companies adapt to an evolving geopolitical and economic landscape. This dynamic environment indicates a continued push for resilience and adaptability within the tech industry, impacting both market leaders and emerging players.

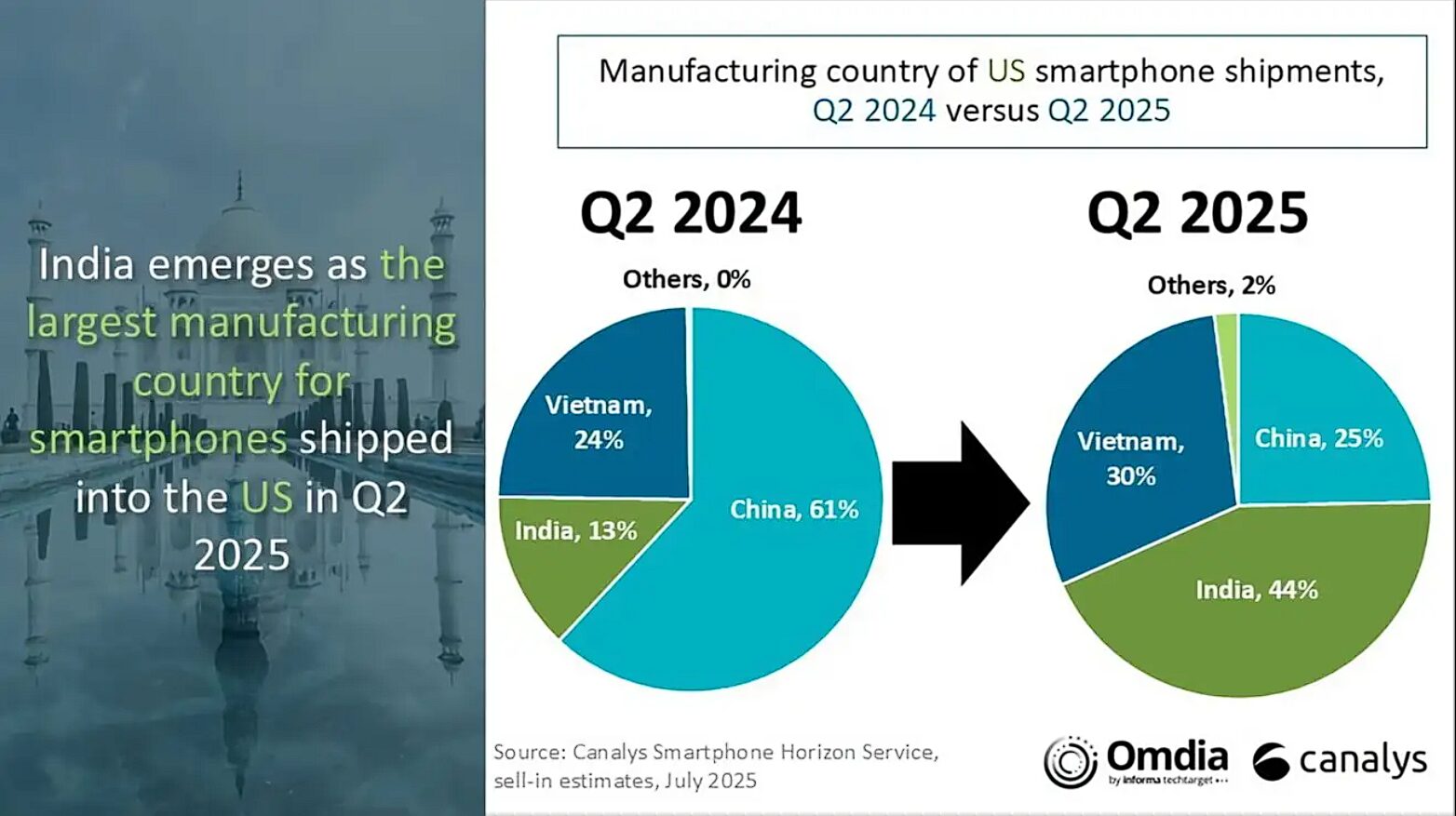

Global Manufacturing Shifts: India Becomes a Major Hub

One of the most striking trends in Q2 2025 was the radical change in the source of smartphones shipped into the US. The proportion of US-bound smartphones manufactured in China dived from 61% in Q2 2024 to just 25% in Q2 2025. India-assembled smartphones, on the other hand, registered a staggering growth with shipments rising 240% year-over-year.

India now contributes a substantial 44% of all smartphones shipped into the US, a huge jump from a mere 13% in Q2 2024. Vietnam also raised its contribution from 24% to 30% in the same time frame. This extreme shift highlights the intentional move by smartphone brands to diversify their manufacturing base and decrease dependence on single locations.

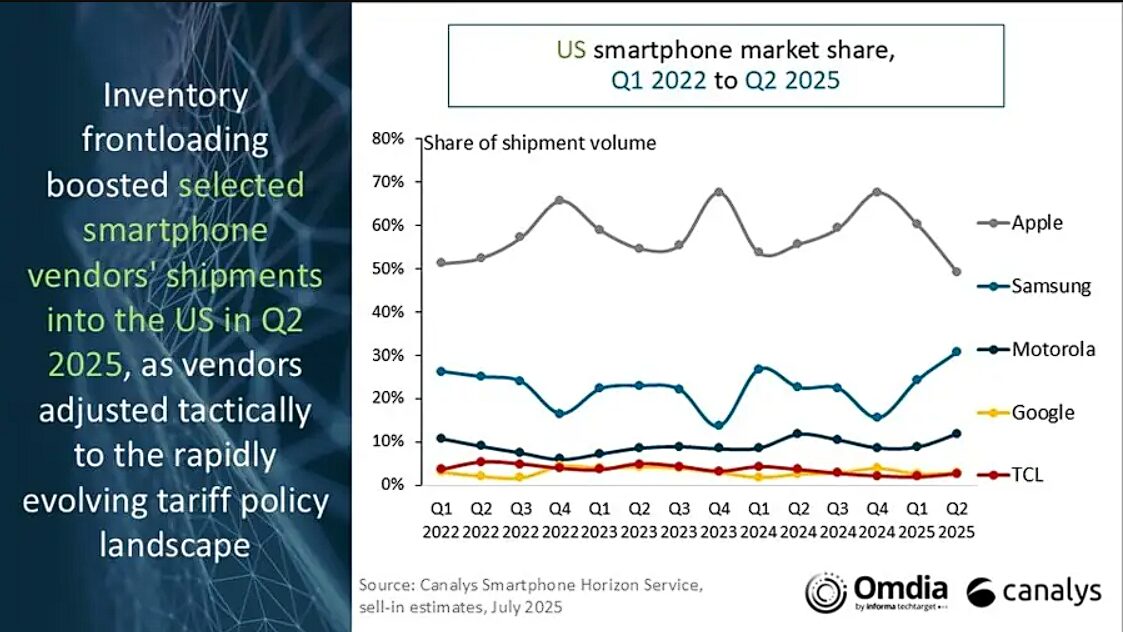

Brand Performance: Apple’s Dip, Samsung’s Surge

The second quarter of 2025 was a mixed bag for top smartphone brands in the US market:

- Apple saw its iPhone shipments fall by 11% year-over-year in Q2 2025, shipping 13.3 million units. That is a major departure from Apple’s 25% growth in the first quarter of the year.

- Samsung showed strong performance as its shipments jumped 38% year-on-year to 8.3 million units in Q2 2025.

- Motorola sustained its growth in the US market, with a 2% increase, shipping 3.2 million units.

- Google took the fifth spot in terms of vendors, with its shipments rising by 13%, totaling 0.8 million units.

TCL experienced a decline, as its shipments fell 23% to 0.7 million units during the second quarter. These individual brand performances underline different levels of success in dealing with the dynamic conditions of the US market and evolving supply chain strategies. The major shift in the locations of manufacturing, especially the emergence of India as a major supplier, indicates strategic recalibration on a long-term basis by leading smartphone players.

Erencan Yılmaz

Erencan Yılmaz